Mutual Fund Predictive Analytics Statistics Overview

Predicting top performing Mutual Funds for short term/long term investment

The analysis was done on the historical returns data available. We selected top 10 Fund Families based on largest Asset Under Management (AUM). The data for this analysis is gathered from Morning Star Website using Web Scraping and from Yahoo Finance using Yahoo finace API. The techniques used to predict good Mutual Funds involve Linear Regression , Random Forest and Cross Validation.

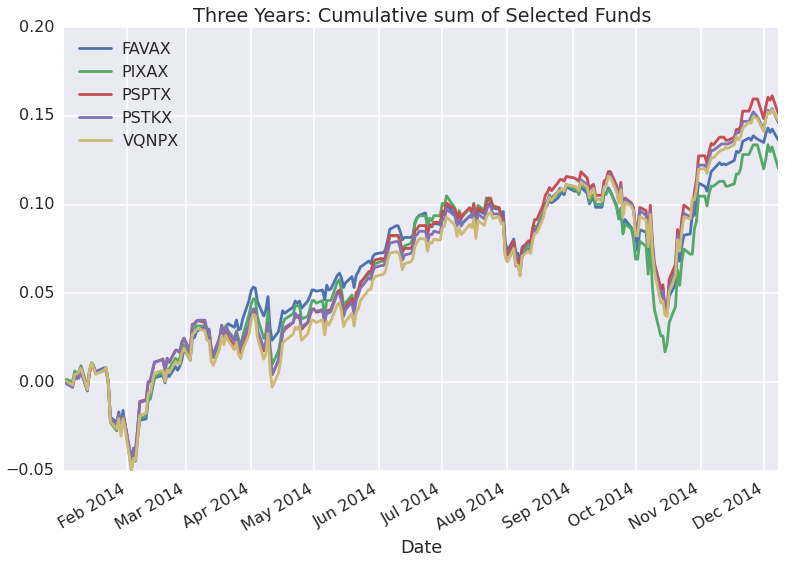

It had approximately 1277 funds from these 10 fund families comprising of all the different Morningstar categories like Large,MidCap,Small, Growth,Blend,Value,Index funds etc. The data from Morningstar was scraped using Beautiful Soup and Pandas read_html libraries. Fund parameters like Alpha, Beta , Sharpe Ratio , Sortino Ratio , Standard Deviation , Returns information, Managemanet Information, Holdings information etc. was available in a annualized form on the website. The fund returns plots(funds comparison) were plotted using matplotlib libraries using Yahoo Finance API etc. The NAV information is available on a daily basis on Yahoo Finance servers which helped us to plot these visualizations.

Based on the analysis of 1200 Mutual Funds for past 10 years, we predicted top performing mutual funds for 3 years, 5 years and 10 years of investment.